Sign in now

Logout

|

You are signed in as guest Sign in now Logout |

|

Plain Talk

|

||||

|

Target is Losing to Walmart: Here’s What the Data Shows

From The Buxton Co The Q2 2023 earnings reports are in and tell very different tales for two U.S. retail giants. While Target’s same‑store U.S. sales fell 5.4 percent, Walmart’s rose 6.4 percent. The same‑store sales metrics alone are enough to raise eyebrows. But sales reports cannot and do not tell the full story. The reality is that Target is losing visits share, and the top rival they are losing to is Walmart. Here’s how we know.

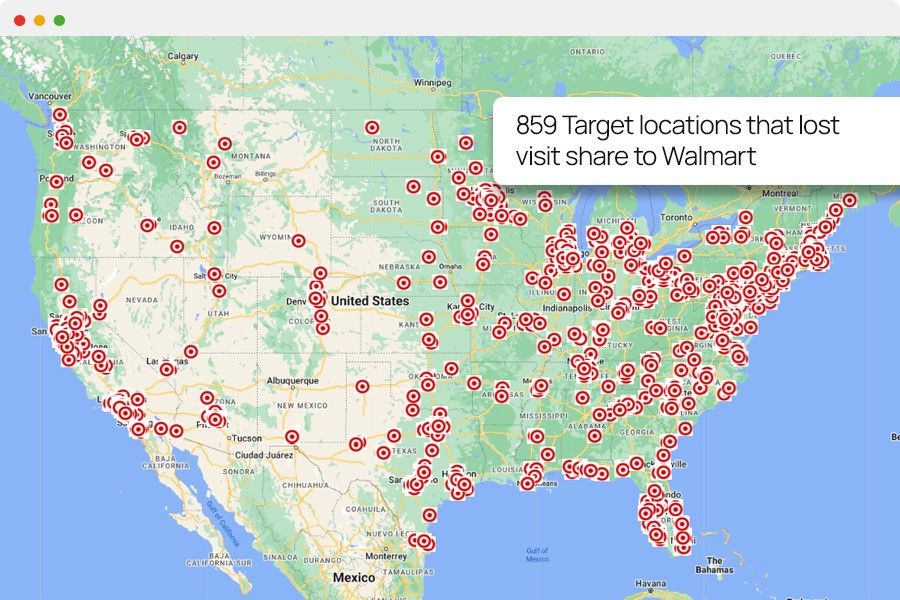

Buxton’s Alert Reports Reveal Target is Losing to Walmart at 859 Locations What’s significant about Buxton’s methodology is that we define the competitor a retailer is losing to based on which brand is attracting visits from customers that live in the retailer’s trade areas and match their customer profile. In other words, we look for the consumers that “should” be the retailer’s customers and identify the other places those consumers visit. Alert reveals that Target lost visits share to Walmart at 859 locations when comparing May 2023 traffic to June 2023 traffic. The locations that lost share were in diverse regions of the country, as you can see in this map.

Target’s competitive traffic woes grew steadily worse throughout the second quarter. In April, they had 794 winning and 183 losing locations. By June, the number had flipped to 171 winning and 859 losing locations. Walmart, on the other hand, saw steady gains throughout the quarter. At a macro level, Target saw more volatility in their trending customer groups than Walmart. Two of the top three customer groups that were trending up for Target at the beginning of the quarter – e‑bid site shoppers and customers with kids 10‑12 years old – were among the top three groups with declining Target visits by the end of the quarter.

Walmart’s top trending customer groups remained more stable, with customers who are married with kids showing up as a top trending group every month throughout the quarter and rural customers being a top trending group two of the three months. The customer groups that trended down also remained consistent.

Diving Deeper: Where Target Needs to Concentrate Its Resources Diving deeper into Buxton’s analytics, we found that while Target has experienced widespread losses to Walmart across the U.S., there are a couple of micro regions where the battle has been particularly fierce. Those are:

These states have been on multi‑month losing streaks during the four‑month period from March through June. In these states specifically, Target is losing these types of customers, and Walmart is gaining some of them:

Know What’s Happening Before Earnings Reports Are Released In Target’s case, keeping a pulse on where they were losing ground to Walmart throughout the second quarter would have allowed them to take early action, explains Buxton SVP of Analytics Adrian Harvey. “If Target could have zeroed in on the struggling areas, they could have launched marketing campaigns and other initiatives to combat those problems.” In the meantime, we’ll wait to see how the battle between these two retail giants plays out. Interested in adding this type of competitive intelligence to your own analytics toolkit? Check out Alert and request a complimentary report for your brand.

If you have an opinion on the retailing or retail real estate industries, take this opportunity to share your thoughts. Articles should run between 400 and 800 words. Topics can, be general in nature, consumer observation or specific to retail concepts or practices. Articles will be posted for at least one week and will then be placed in the Editorial Archives. All articles submitted will be read and considered but we cannot guarantee publication. Each published article will carry the submitters byline (if desired) and is a free service to our community. Article ideas and suggestions are also always welcomed. Contact PVS@PlainVanillaShell.com

|